De Jure Legacy

Rooted in purpose. Built with intention. Designed for impact.

Welcome to a space where ideas become action and vision turns into results. With clarity, strategy, and connection at the core, we help you create a legacy that lasts.

Strategy Starts Early

De Jure Legacy exists to help young adults and families understand the systems they’re navigating, so they can build careers, income, and independence with clarity instead of guesswork.

The insights shared here are grounded in research on how opportunity and mobility are structured in the United States and why access, risk, and reward are not evenly distributed. By learning how systems actually work, from education financing and housing to banking, employment, and entrepreneurship, young people are better equipped to make informed decisions, avoid common traps, and plan their paths strategically.

This work shows up in multiple ways: public resources like scholarship guidance and research-based insights, ongoing education through our newsletter, and optional tools for deeper learning in financial and legal literacy. Families can engage at the level that fits their needs.

Fewer than one in five U.S. adults report taking a personal finance class in high school. Only 19% took a personal finance class, and most say they weren’t fully prepared for real-world money management.

Though some states have adopted requirements, less than a quarter of public high school students actually have access to comprehensive personal finance courses.

Access to financial education is deeply unequal: in low-income schools (with high rates of free/reduced-lunch eligibility), only ~4% require a personal finance semester compared to much higher rates in wealthier schools.

👉 What this means: Many students graduate with little or no formal understanding of budgeting, credit, debt, or savings, even though these skills impact lifelong financial outcomes.

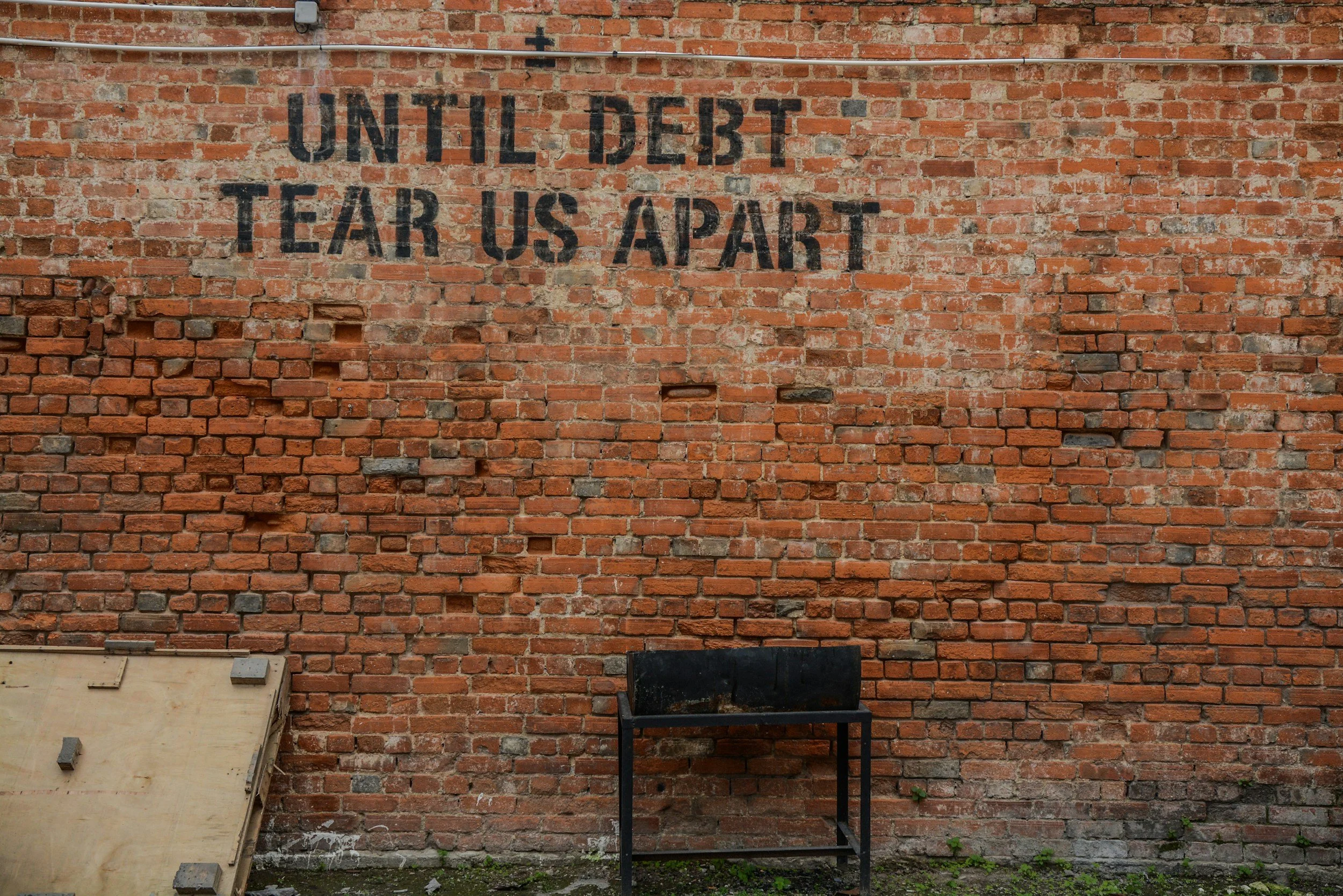

🎓 Student Debt and Wealth Building

Student debt is a major financial burden for millions of Americans, with racially marginalized borrowers more likely to hold large student loans and struggle to repay them. These student loan borrowers report higher debt levels and are more likely to remain in debt over time.

Even among college-educated households, significant racial wealth gaps remain, demonstrating that educational attainment alone does not neutralize structural economic inequality.

👉 This shows: Borrowing for education doesn’t automatically translate to financial freedom, especially when wealth gaps and repayment burdens are unequal.

💼 Entrepreneurship and Capital Access

Entrepreneurs from racially marginalized backgrounds are far less likely to receive financing than white entrepreneurs, which restricts growth and profitability.

Lower business financing access, combined with higher debt and lower family wealth overall, discourages business formation and slows wealth accumulation in marginalized communities.

👉 Takeaway: Starting a business can be a path to economic mobility; but unequal access to capital limits who can successfully build and scale ventures

Legal Literacy is Power

Many adults are not fully aware of the laws that safeguard or restrict them. Covering topics such as contracts, credit, and workplace rights, these resources are designed to help your young adult understand how the system operates before challenges arise. Begin here to provide them with a valuable advantage.

With us, you can take advantage of the following valuable opportunities and resources:

Free Resources

Quick tools. Concrete answers. Free downloads and guides to help youth improve money management, with no commitment.

Workshops that work. Live and virtual sessions where we cover everything from taxes and scholarships to career tools and credit cards. Ask questions. Get answers. Build smarter..Legacy Journal

When financial literature meets reality. We analyze banking, credit, investing, and generational wealth, all in clear, accessible language for young legacy builders.

Legacy Program

The wait is over! Start building your financial skills today with lessons on budgeting, saving, credit, investing, passive income, and entrepreneurship — all designed for teens and young adults.Financial & Legal Literacy for Teens and Young Adults

The Legacy Program brings the foundations of money management, investing, and entrepreneurship to life for young people. Through interactive lessons, gamified challenges, and practical tools, students learn how to budget, save, build credit, generate passive income, and explore business opportunities, all while understanding their legal rights and protections.

It’s a financial literacy roadmap to financial freedom, confidence, and a legacy they can be proud of. Let your student start building their skills today and take control of their future.